Fair Forex Brokers is the leading resource on online trading, be it in forex, CFDs, cryptocurrencies or other financial instruments. Other than broker reviews, our site reviews trading signal providers and auto trading robots. We have not only created advanced trading guides, a trading academy, trading software reviews and but also frequently introduce traders about latest news in the industry as well as potentially dangerous services. The biggest advantage for readers are the tested brokers, recommended by Fair Forex Brokers. Below you can find the the best brokers as judged by our experts.

Fair Forex Brokers

FairForex Reviews

While you will find many offers to trade forex online, traders may find it hard to grasp what are the fair forex brokers and how does one trade on fair forex. The term forex is short for foreign exchange. When we talk about forex, we mean exchange of foreign currencies. The term Forex stands for Foreign Exchange where as FairForex is a way to ensure the rates you are getting quoted are fair and the brokers you trade with are giving you fair prices and quick payouts.

This is the world’s biggest financial market where daily forex trading volumes reach up to 5 trillion USD. Online forex trading makes just a part of the overall trading that takes place there. Imagine a car company, like Volkswagen, that needs to import car parts for its German production facilities, from Canada. In order to pay for the order, they need Canadian dollar (CAD), but they earn their money in EUR. Then they will use forex to exchange their EUR for CAD in order to pay their suppliers in Canada. Daily there are millions such transactions, big and small, that take place on forex market, opening various opportunities for traders to try to predict how currencies will move and try to earn some money from it. This is not always easy, and there are risks involved, as with any transaction in the financial market.

FairForex trading is the most popular way of trading nowadays. The underlying asset in this case, are currency pairs, and most brokers offer a great variety of major and minor pairs. The most interesting thing is that traders never have to actually own a currency as they are trading foreign exchange (or forex) contracts for difference, and not the currency itself. Traders can trade with many licensed and well-regulated brokers that offer forex trading with user-friendly minimum deposits that start at only $10 in some cases.

Forex contracts are derivative products. This means their value is derived from underlying asset. This means that traders do not need to enter complicated broker relationships, invest huge amounts of money and pay exorbitant fees in order to speculate on value of assets. You can use minimum money and enter the market through the derivatives.

Technically Forex contracts that are exclusively based on currencies. As previously explained, the profit and loss comes from the difference in buy and sell price of a currency – the exchange rate. Since there are many currencies across the world, and even more currency pairs that form exchange rates, forex trading offers many contracts on a daily basis, around the clock since currency market never sleeps.

Here are some of the most popular pairs we see traded among the FairForex traders using our site.

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- USD/CAD

- EUR/JPY

- EUR/GBP

Others include basically any combination imaginable and available. Some pairs will naturally have wider spreads due to low volume of trading – low volatility. Some pairs move together, while some others move opposite – creating hedging opportunities .

Forex trading is legal in many countries, however, every country or entire region like the European Economic Area, has a specific attitude towards online trading via forex, CFDs, cryptos or binary option trading, so it is recommended to check with the local regulator. Thanks to market regulation, the trading environment has become more reliable for the traders. In Europe (EU) brokers can obtain licenses by CySEC, FCA and other national bodies. Thanks to the EU MiFID directive, all the brokers regulated by one regulator have access to the complete EU single market in financial services through the Union wide passporting rules. It is then up to national regulators to specify rules that should apply in their jurisdiction.

However, since August 2018, the European Securities and Markets Authority (ESMA) has prohibited the marketing, distribution and sale of binary options to retail investors in the European Economic Area. The ESMA has also enforced certain restrictions on contracts for difference (CFDs) trading for retail investors, such as leverage limits, margin close out rules and the use of specific warnings which should be delivered in a standardised way.

Fair Forex Brokers recommends only trading with regulated brokers no matter the country you are coming from.

Forex Brokers Guide

If you go online, you will find many forex brokers guides about how to trade currencies on forex. Many of them focus on the financial analysis part, however, many beginners have issues understanding the basic concept that is behind the trading process, let alone complicated financial analysis.

Forex brokers are companies that offer the service of trading on a platform with different assets, depending on their area of expertise. Best forex brokers offer trading on multiple devices, demo trading accounts, reasonable minimum deposit, and user-friendly terms and conditions. We have done all in our power to create objective forex brokers guide in order to make sure traders get the relevant information about the best forex brokers.

Traders can read about special features these forex brokers offer, their trading platform, bonuses, deposits, withdrawals and more! All the relevant info we compiled in our forex brokers guide is presented in a way that is easy to understand. We have listed some features and trading conditions that can make or break the trading experience with forex brokers.

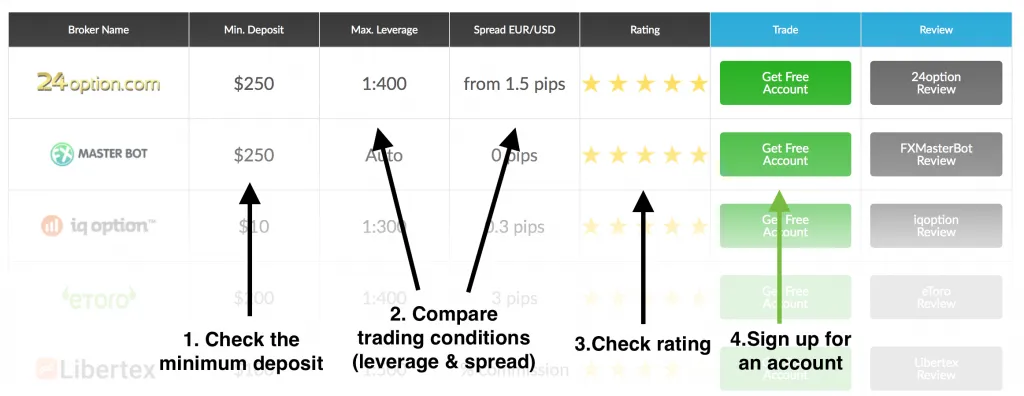

Make sure to check out our forex brokers list. There, you will find several brokers we believe offer the best trading conditions, and solid trading experience. But, never select the broker only based on web design and logo. Here are some tips on how to compare forex brokers before you start trading.

One of the best ways to do a proper broker comparison is to check the trading conditions: minimum deposit, spreads, leverage, maybe even bonuses, and not to forget – withdrawal conditions. Also, check out the trading account types available and do some math to see how many contracts you can buy for a minimum deposit and how will minimum trade requirements affect your trading liquidity.

Check out the reviews to find out what platforms are offered. Most forex brokers offer multiple trading platforms. If both brokers offer the same type of platform, look for a mobile trading app or a demo trading account. Not all brokers have the same level of service even if they have the same platform provider. Check their lists of underlying assets and find one that suits you better.

Most brokers you will encounter in our reviews are regulated, brokers. That means that they have a license for operating their business provided by at least one regulatory body. It is always a wise decision to trade with a regulated broker, as forex traders get an additional safety net in case they find it troublesome to communicate with their broker. Also, regulated brokers have to oblige many rules and regulations in order to keep their license which means a higher level of customer protection for you.

Forex broker spread is the difference between ask and bid price. For example, in forex trading, the EURUSD pair may be valued at 1.1234. However, if you wish to buy EURUSD contract, you have to pay the ask price that can be somewhat higher – for example, 1.1236. The seller gets for example 1.1232. The difference between the ask and bid price, 0.0004 is called a spread – 4 pips in this case. Even though it seems quite insignificant, try to do the same math with large numbers and you will quickly notice how your perception of the importance of spread might change.

You will notice some forex brokers do not have spreads for EURUSD (its 0 pips), or they are much lower in general. These brokers are so called ECN brokers which route orders directly to the liquidity market. They will not charge spreads, but they do charge commissions for each trade placed and closed. The commission can range from few USD to even $22 in some cases. For small forex traders spreads will mostly be more interesting since they do not like paying commissions that are a huge proportion of their trading margin. However, commissions are fixed costs for large traders and they prefer them to spreads. Brokers that have ECN execution are FXTM or IronFX which offers both kinds of trading accounts.

Leverage is a certain amount of money provided by the forex broker that traders can use to increase their invested amount. 0.5 USD seems like a really low amount to win with 100 EUR invested, right? Seems easier just to wait for a year to get similar return by depositing the money in a bank. This is where leverage comes in. In forex, but in CFDs trading as well, as we will see below, traders can use the leverage to move more money in total, per trade. It works like a lever – you invest 100 of your own money, but by using leverage, the lever enables you to raise several times more money which you can use for trading.

This is also called margin trading, since all trader needs to do is ensure that it has enough margin (in this case, 1%) to cover the positions. Don’t mistake leverage for binary options bonuses. Leverage has terms that apply and in case your trades are not going as expected and your margin cannot cover potential losses, you’ll receive a margin call. This means you need to deposit more or close the positions.

Leverage – Use borrowed capital to increase the return of your investment

If leverage is 1:10, it means that instead of buying just 100 EUR with your USD as in our example, you can actually get 1000 EUR, or 10 times more by investing 1141.2 USD to buy 10 times as much EUR, with only 114.12 USD of your own money. In this case you have not earned 0.5 USD after the exchange rate rose and you sold EUR back for USD, but you actually manage to gain 10 times more – 5 USD. And these changes in exchange rate happen all the time, in both directions – with or against your prediction.

Leverage works other way too, you can lose more money than otherwise – in this case, if it was opposite, you would have lost 5 USD. If you lose too much, you get a popular margin call, meaning that your account has incurred so many losses that the broker won’t allow more trading unless you deposit more. The required margin is the amount of money you need to have on your account to execute the trade and cover potential losses. In our example, after you invest 100 you have to have money in your trading account left in case the price moves so much against your prediction that your loss exceeds your initial investment.

FairForexFX Review

FairForexFX is a forex broker that offers the MT5 forex trading platform. This broker offers over 45 fx currency pairs, stocks, commodities, as well as cryptocurrencies. Spread is one of the lowest and it goes from 0.0 pips with FairForexFX and the leverage is as high as 1:400.

FairForexFX offers a demo account to its traders and it is very easy to sign up for a demo from the top menu.

FairForexFX App

FairForexFX is taking advantage of the MetaTrader 5 platform. Broker does not have its own mobile application, however, FairForexFX traders can benefit from the MetaTrader 5 mobile app that is supported by this broker.

FairForexFX Login

In order to start trading you need to open FairForexFX account. Broker provides 3 different account types for its traders. You can choose between Raw Spread Account, Standard Account and Pro Account. After you have created your trading account, you can do FairForexFX login from the top menu and start trading on FairForexFX platform.

FairForexFX Minimum Deposit

FairForexFX minimum deposit is $100. This is very attractive since the amount is on the lower side of the industry average. If you decide to sign up for a FairForexFX Pro Account, the minimum deposit is $10,000.

FairForex Ltd

Fair Forex Limited is the company behind FairForexFX broker. This offshore company is registered in Saint Vincent and the Grenadines. There is no licensing regime in place for financial service providers that are registered within this jurisdiction and we would definitely advise you to do your own research if you decide to sign up with this broker.

CFD Trading Guide

CFDs are acronym for Contracts for Difference and we will try to explain it in more details in our CFD trading guide. It’s a type of financial instrument that makes it possible for traders to win, or lose, on the difference between the strike price and the closing price of an asset. Strike price is the price that some asset had in the moment you bought a CFD. Let’s say you bought CFD based on price of Apple stock that cost 150 USD per share.

If you think the price will rise from that point, you are entering a “long” position by buying. If you believe it will fall, you will enter “short” position by selling. When you close the contract and your expectation was correct, you will get profit based on the difference between the price you bought at (strike price) and the price the contract was sold at (closing price). If you predicted wrong, the broker deducts the difference from your trading account.

With CFDs you can trade based on almost any assets that can be used as the underlying asset for the contract. It’s not just currencies, like with forex – you can enter trades based on price of gold, wheat and other commodities. Also, stocks, options, bonds and other instruments can be used as underlying asset for a CFD enabling trders to virtually enter every global market. The asset list that is offered mostly depends on the broker that offers CFDs and their platform, but nonetheless, the flexibility and simplicity of this kind of trading literally puts global market at the palm of everyone’s hand. Just launch the platform and start trading!

With CFDs and Forex, losses and profits are variable, depending on the fact how much the asset price or exchange rate changed, but the trader can decide when to close the position, thereby limiting losses or locking in profits without the need to wait for expiry time. This lets traders have additional flexibility and adds to ways one can manage risks of the trading portfolio.

Cryptocurrencies have slowly taken the spotlight. After a whole decade in shadows, they are now the stars of online trading. Great increase in price of Bitcoin, forced traders (and market specialists, scientists, and analysts) to finally pay attention to this underground trend.

Meanwhile, many CFDs brokers offer cryptocurrency trading which has seen increased interest ever since Bitcoin first time hit $1000 few years back. Since the prices, in terms of USD, skyrocketed in 2017, traders are eager to profit from the upward trend that seems to be the norm, but also want to ride the huge volatility that makes cryptocurrencies so risky.

Some brokers offer outright buying and exchange of cryptocurrencies, like eToro. Others offer CFDs which can in many cases make more sense since one is not stuck owning a very volatile cryptocurrency and one can also trade agains the price. In this case, many treat cryptocurrencies like FX pairs, meaning the prices are set against EUR or USD. So you trade BTCUSD like any other currency pair. Some have BTC as CFD instrument where one trades on the USD price, which is basically the same.

One of the main characteristics of different types of CFD brokers is the underlying assets portfolio. While some traders believe the more assets they have available the merrier, that is not necessarily the truth. It is, most of all, important that the broker supports the assets and types of trading you are interested in.

Cryptocurrencies can be offered by crypto brokers, forex brokers, binary and CFDs brokers. If you want to buy and sell cryptocurrencies, not just bet on them, it is better (although more complicated and risky) to use a crypto exchange.

CFD Brokers

CFD brokers are companies that are offering customers to trade based on underlying assets, but the trading takes place at a special software platform integrated on the website or downloaded on a computer. Some brokers prefer to develop their own trading platforms, also called proprietary platforms, while others simply outsource the platform development to reliable software companies.

Platform is the software solution that traders use to trade. From the user side, it usually includes a big chart for analysis on one side and a list of available assets on the other side. CFD brokers offer several trading platforms.

MetaTrader4 and MetaTrader5 are the most popular CFD platforms. This is a software solution that requires a download on your computer. After a login with broker credentials (username and password), traders get all the familiar features of the platform and more. MetaTrader software includes various chart analysis tools and advanced indicators for assistance with the trading process. They also have the option to install various add-ons like automatic traders, additional analysis tools, strategy advisors and more. To find out how to trade using MetaTrader 5, read our guide!

Some brokers develop their own proprietary platforms, trading software that needs to be downloaded and installed, like MetaTrader in order to start trading.

Web platforms are online software that works from your internet browser (Chrome, Safari, Internet Explorer, Edge and others). There is no need to download software. Traders just click a button on broker’s website and they enter the trading platform that enables instant trading of forex contracts and CFDs.

Meanwhile trading can be done also via mobile phones. Smartphone apps that are offered by brokers enable customers to trade from every place where they have mobile internet. This allows for a full control of the trading process so no opportunity is missed. One can also act on bad news from the markets and exit positions without having to go home to her computer.

There are many ways to choose the trading currency. In our academy we have covered this topic already – learn what are majors and crosses and how to choose trading currency.

If you want to trade other kinds of assets – like gold, stocks, bonds etc, you will use CFD contracts. There are almost 10.000 CFD contracts offered daily on broker platforms, meaning there is more than enough trading opportunities out there. Assets that can be used as underlying to CFD contracts are

Commodities are various metals and ores, but also materials such as sugar, wheat or cotton. Some of the commodities that are popular include

- gold

- crude oil

- wheat

- cotton

- soybean

- sugar

- natural gas

- heating oil

- copper

- platinum

- palladium

Stocks are shares of companies listed on various exchanges. Since their prices fluctuate according to new information that becomes public from day to day, they are also used as a base for CFD contracts. Everyone will recognize the most popular companies like Apple, Microsoft, Coca Cola, Disney, Gazprom, Volkswagen, BMW and others. Now, with CFDs, if you are interested in performance of these companies and their stock prices, you have access to the market in order to speculate on their value, since there is no need to acquire the ownership of the stock.

Bonds are so called “I owe you” or IOUs. For the issuer it is debt, for the owner it is the right to a certain amount of interest and a full amount when the bond matures. Bonds are usually the way governments and companies to finance themselves. They prices move too, so they are also available to form basis for trading.

Fair Binary Options

Fair Binary Options was an binary options affiliate website with a mission to represent a truly fair approach to binary options and the trading industry in general. Our vision was to be the first choice gateway to binary options, offering best broker and trading advice coupled with a useful education platform.

FairBinaryOptions.com was first launched in October 2012 by a team of inspired people with affiliate industry background and years of experience.

Since the launch, many clients recognized the values that Fair Binary Options stands for. As already indicated, our mission is driven by client focused values, with the goal of providing the best trading support for all users. Our values are reflected across all our activities – from the trading strategies we offer on daily basis, free signals for registered users, to an honest approach to broker reviews and customer treatment. All our reviews reflect our thoughts and experience, and we take great pride on the quality of our approach.

Since we started, we have been regularly communicating with our customers, trying to support them as they trade. We represent their interests with brokers, and have no problem removing brokers, who don’t act in accordance to our values, from our list. We are working hard to ensure that all of our recommended brokers conform to highest standards when dealing with clients.

By providing rich educational opportunities, we are in essence investing in our clients. Our goal is to help them get better at trading while they gain understanding of the market. It is important for us to communicate the fact that, as with anything else, passion and hard work will get you results. We don’t advertise “how to get rich fast” schemes but try to explain how to trade and earn profits by becoming a smart investor.

This is what we believe makes a great online destination for everyone interested in binary options – but we are never done. Our goal is to add new features and innovate as we grow, and we invite all readers to take this path, and grow with us. Check out the trading academy, new weekly strategies, daily signals, our reviews and the fun and educational video section. As always, contact us if you may have any questions, we are there for you.

FAIR BINARY OPTIONS was an iGB Award winning binary options portal. The industry has recognized the importance of our website with two iGB awards, as the iGB Awards Best Binary Affiliate 2014 and iGB Awards Best Finance Affiliate 2015, we are sure our visitors will come to realize all the advantages it offers. As the best Affiliate website for finance in two consecutive years, we feature a range of services that are beneficial to traders and to those who are trying to get credible information on binary options.

Fair Binary Options started it’s transformation towards Fair Forex Brokers in 2018. and switched focus from binary options to forex and CFD trading.

FairForexBrokers.com consists of an international website commonly, but our portfolio does not stop there and includes a wide range of local websites sites that allow our members around the world to read our reviews in their own languages free of charge. You can get to them by accessing the language menu in the top right corner.

Fair Forex Brokers puts a lot of time and energy into following the latest trends and providing a balanced insight into the world of trading, whether it is crypto, forex, binary or CFDs. This is our mission from the very start, when there was still a Wild West situation on the market, without proper regulatory framework. We strive to keep up with the latest market trends and review the newest brokers on the market. We also review other types of trading products and gives traders a deeper insight on binary and forex trading robots software.

We at Fair Forex Brokers follow changes and developments in online trading industry and review brokers for all major groups of online retail trading instruments.

Fair Forex Brokers in Other Languages

Arabic: تداول في الخيارات الثنائية

Danish: Forex Trading Danmark

Spanish: Deriv Brokers en Español

French: Meilleur Courtier Forex France

Italian: Migliori Broker Forex Italiani

Lithuanian: Forex Brokeriai

Dutch: IQ option Nederland

Polish: Ranking Brokerów Forex

Romanian: Cel Mai Bun Broker Forex

Swedish: Forex Mäklare Sverige

Turkish: IQ option Türkiye

Ukrainian: брокери бінарних опціонів